During the past two plus years now, Pakistan’s real estate sector has been under severe pressure. This was initially generated by the political turmoil and economic uncertainty across the country. However, the situation was worsened by the prevalent stagflation, which encompasses the dual challenges of rising prices and shrinking disposable incomes.

In this blog, we will outline the impact of taxes that have either been imposed, or revised for the budget 2024-25, which comes into effect from 1st July, 2024.

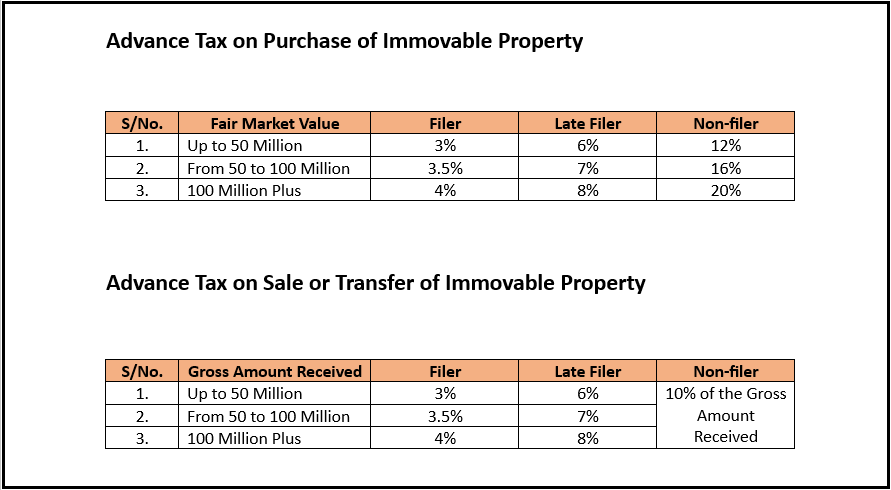

Analysis of the Taxation Rates

It is evident from the above tables that the Government wants to discourage the arbitrary practice of filing income and tax returns, just for the purpose of avoiding a higher taxation rate. The primary aim of such progressive tax slabs is to incentivize people for timely filing of returns.

Capital Gains Tax (CGT) on Immovable Property

- For properties acquired before 1st July, 2024, the tax rates shall remain unchanged.

- So far as properties acquired after 1st July, 2024 are concerned, a flat rate of 15% is applicable for filers.

- The provision of holding period, which used to previously impact the rate of capital gains tax, has been removed altogether.

- For non-filers, a progressive tax rate has been proposed, which in any case would be higher than the 15% rate, applicable on filers.

Exemption from Withholding Tax

Only to the extent of one immovable property per fiscal year, serving and retired Government officials have been exempted from payment of withholding tax. Although this relief is somewhat selective, it is still being dubbed as a sigh of relief for the real estate sector.

Overall Impact of Budget 2024-25 on Real Estate

If we conclude regarding the overall impact of this budget on the real estate sector, it is expected to be neutral. Having said that, if the Government is able to improve the country’s macro economic indicators, we think this should generate at least some activity in the real estate sector.

Contact Brick Marketing & Developers (Pvt.) Ltd. for highly professional services regarding Pakistan’s leading real estate projects.